Executive Summary

Per-capita alcohol consumption has seen an almost 3 fold increase since 2005 in India. A young population with ~50% above the legal drinking age, rising affluence, rapid urbanization and changing societal attitudes are driving this growth. However, alcohol consumption and IMFL penetration are not uniform across states indicating opportunities for growth of both economy and premium products. Mature markets are seeing increasing premiumization leading to expanding demand for Grain based ENA. Supply and cost pressures on Molasses based ENA due to the impetus on ethanol blending program, is leading to diversion of MENA production capacity to ethanol and a ~10% – 15% rise in ENA prices. This is expected to further augment GENA capacity leading to a ~186% growth between 2017 and 2022.

Supply security and sustenance of bottom-lines through cost reduction programs, alternate and innovative sourcing strategies are key challenges IMFL companies face in the short term. Economy segment strategy also becomes critical in the long run as cost pressures need to be balanced with potential opportunities in graduating country liquor consumers. While regulations prohibiting direct advertising pushed IMFL players to brand extensions, income generation potential from these businesses can be exploited to augment profits.

Alcohol consumption is rising as a social activity with increasing penetration and per capita intake

For many years, societies have discouraged individuals from alcohol consumption. Traditionally, alcohol consumers had largely fallen into one of two broad economic segments of the population – the elite, who enjoyed their drinks in the company of friends and family and the economically weak, who drowned their sorrows thanks to the intoxicating effects of liqour.

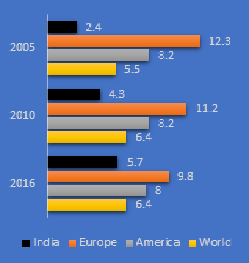

The widespread negative impression around drinking had kept per capita alcoholic consumption to as low as 2.4 until 2005, as against 12.3 for Europe and 8.2 for the USA (Ref. Chart 1) as per data from the World Health Organisation. A dramatic shift in behaviour seems to have occurred since then, across both India and Europe. While India saw a 2.5x growth in individual consumption, Europe has seen a ~20% contraction. Qwixpert’s analysis attributes the rapid increase in Indian consumption to three key factors.

Chart 1 – Per capita Alcohol consumption

Foremost among these is the increasing acceptance to drinking as a social activity. A recent study1 by IMRB-NFX, on behalf of National Restaurants Association of India, has found that 54% drink casually at social events. Respondents believed how celebrations have become incomplete without moderate alcohol. Easy access to information on the internet and awareness through social media have also contributed to the rise of social drinking.

While consumption is increasing, so is the need to ensure responsible drinking. This trend is increasingly becoming prevalent among millennials (21 – 35 yrs. old)1 who are placing a great emphasis on consuming within limits. This has come as a boon for the “Bars and Pubs” segment who target the millennials and are growing at 23.5% annually3. This segment is expected to continue growing at a similar pace as India has a very young population with median age of 28 yrs2 and is likely to remain so in the near future.

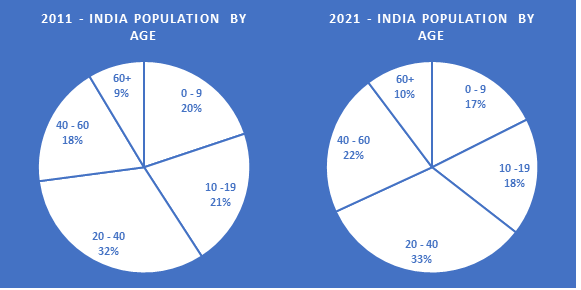

Chart 2 – Split of India’s population by age – Median age 28 years

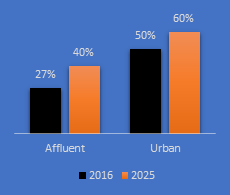

Chart 3 – Household composition

Favourable demographic mix with ~50% above the legal drinking age of 25 yrs has also contributed to increasing consumption. This mix is expected to become 56% in 2021 according to a report2 by MOSPI. This coupled with increasing urbanization and affluence (Refer Chart 3)4 will continue to positively impact liquor volumes through increased per capita consumption and enhanced penetration.

While a large majority still consume country liquor / indigenous drinks, state level differences in IMFL penetration opens up opportunities for customized strategies

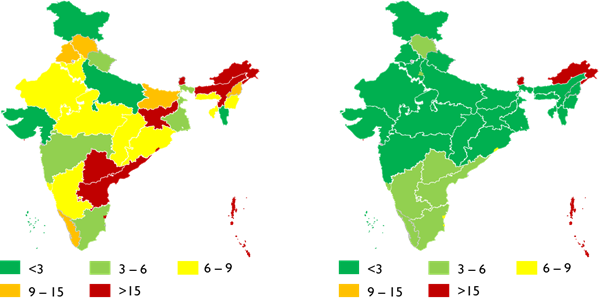

This consumption is heterogenous and according to a NSSO survey6, per capita consumption by state varies from 1.6 litres/ year in Mizoram to 57 litres/ year in Arunachal Pradesh. Most of this intake is in the form of country liquor, toddy and other indigenous drinks. Only, 7 states have >50% contribution of IMFL & Beer in overall liquor consumption. IMFL manufacturers need to design state level strategies to target increased revenue contribution from premium IMFL in these 7 states while driving migration to the “low-priced” economy segment from indigenous liquor in the remaining 22 states.

Chart 4 Per Capita Alcohol Consumption (Ltr/ Yr.) Chart 5 IMFL + Beer Per Capita Consumption (Ltr/ Yr.)

Premiumization is on the rise in Indian Made Foreign Liquor

Chart 6 – Premium Alcohol sales growth (2018 vs 2015)

In mature markets with higher IMFL consumption, analysis of sales of various IMFL manufacturers suggest a growth in Premium alcohol volumes. Industry leaders have also seen this segment grow at 15%+ since 2015. Qwixpert research expects premiumization to continue further as industry leaders are re-orienting their resources to focus on premium IMFL sales while operating franchisees to ensure presence in the “economy” segment.

Capturing consumers with increasing disposable incomes migrating upwards to premium drinks and the millennial demand will be a key focus area for IMFL players. Industry experts believe this will lead to significant increase in malt spirit demand. With a significant portion of current demand serviced by imports, investments in new malt spirit plants are mushrooming as local cost-effective sources are being searched for by IMFL players.

Premiumization has also led to changes in the dynamics of ENA (Extra Neutral Alcohol) consumption in the industry. ENA contributes to 42.8% of most IMFL drinks. The industry has traditionally utilized molasses based ENA due to historical supply and cost advantages. Grain ENA, or ENA produced from grains unsuitable for human consumption, has been preferred by the best whiskey brands9 and IMFL companies are not to be left behind. While Pernod Ricard uses Grain ENA for 100% of its products, United Spirits’ Prestige & Above segments are 100% Grain based10

Ethanol Blending Program is diverting ENA capacity to ethanol; IMFL players are facing raw material supply and price pressures

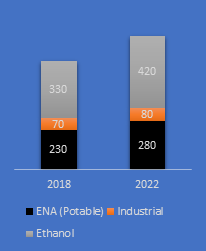

Increasingly companies are shifting from MENA (Molasses based ENA) due to plateauing production of Molasses (Sugarcane) and diversion of MENA distilleries to ethanol production thanks to the Ethanol Blending Program (EBP). Oil Marketing Companies (OMCs) have been set a target of 10% ethanol blending by 2022, with a potential savings of Rs.12,000 Cr.11 on fuel imports between 2018 and 2022. An additional ~180 Cr. Litres of ethanol annually is required to satisfy the demands of the Oil & Gas industry.

Chart 7 – Ethanol/ ENA demand (Cr. Litres)6

In order to fast track progress on the EBP initiative, in 2018, the government increased procurement price of ethanol from sugarcane by 25% from Rs. 47/litre to Rs. 59/litre. Further, B-heavy molasses-based ethanol is now 11% more expensive at Rs. 52/ ltr5.

ENA manufacturers are seen investing in converting distilleries from ENA to ethanol production to take advantage of the higher prices. This has led to an immediate contraction in ENA supply for the IMFL industry and ~10% – 15% increase in raw material procurement costs. ENA cost pressures have had an indirect impact on the push for premiumization from IMFL leaders. Contribution margins are decreasing in the price-sensitive economy segment driving focus on premium segments for sustaining profitability. A successful economy segment strategy will have to be built at a state level, considering current and projected market maturity for IMFL, production costs and business benefits of market coverage.

To guard against supply risks IMFL players must re-calibrate their ENA in-sourcing mix. Qwixpert analysis also indicates ENA procurement cost reduction opportunities existing in vendor consolidations and innovative sourcing contracts, to avoid spot purchases and secure ENA supply. Further, it is imperative that IMFL manufacturers focus on value engineering, alternate sourcing and innovative pricing techniques in packaging material for profitability.

Basis discussions with CXOs and experts in the industry, Qwixpert understands that GENA production is also burgeoning due to diversion of molasses to ethanol production. Increasing cost of regulatory compliance of discharge and complexity in managing effluent treatments plants for Molasses ENA distilleries, incremental revenue opportunity from DDGS (Distiller’s Dried Grains with Solubles) are also compelling IMFL players & ENA suppliers to set-up more GENA production units. Thanks to the abundance of “consumption unsuitable” grains, Qwixpert estimates the GENA capacity to grow by 186% from 88 Cr. ltrs. in 2017 to 252 cr. ltrs. in 2022. IMFL manufacturers investing in GENA capacities need to build detailed business cases to evaluate benefits of in-sourcing vs procurement.

Brand extensions: Necessity or opportunity?

The Cable television network (regulation) amendment bill12, which came into effect on 8th Sep 2000 has prohibited advertisement of alcoholic products on television. As a result, the companies have to limit promotional activity to point of sale or surrogate advertising using brand extensions like glasses, mineral water, music CDs etc. having identical brand names. Advertising Standards Council of India (ASCI) has set specific guidelines to qualify a brand extension product basis in-store availability of the product – at least 10% of the leading brand in the category the product competes (as measured in metro cities where the product is advertised) or turnover of the surrogate product or service at a minimum of ₹ 5 Cr. per annum nationally or ₹ 1 Cr. per annum per state where distribution has been established8. Further, these numbers have to be validated and certified by an independent organisation such as ACNielson or category specific industry association.

With tightening margins, alcohol manufacturers are no longer looking at brand extensions to keep the regulator off their backs but to make it a profitable business division. Products, such as water, soda and soft drinks, with synergies at similar points of sale as alcoholic beverages can beef up the bottom-lines with adequate strategic focus.

Authors: Maheswaran Ganapathy, Giridharan Raghunathan, Gopika Hemachander