Executive Summary

The pandemic hit India in February-March 2020 setting the healthcare industry in overdrive. Patients needed treatment for a hitherto unknown and highly contagious disease, for which the healthcare sector was not prepared. Hospitals and clinics faced a shortage of beds, medicines, consumables, doctors, and lifesaving medical equipment due to both supply disruptions and spikes in demand. Being a truly globalized sector, supply chain disruptions were acutely felt due to import restrictions, logistic hurdles, shutdown of manufacturing operations and labour migration.

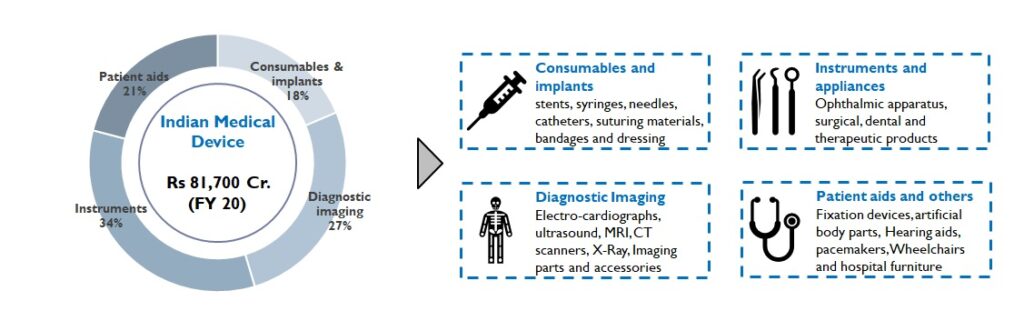

At a broad level, the healthcare sector can be divided into 3 sub-sectors – (a) infrastructure (hospitals, diagnostics, clinics, dispensaries), (b) pharmaceuticals (medicines and APIs), and (c) devices and consumables. Devices and consumables, made from various sources – fabric, plastic, rubber, metal – is a ~Rs. 81,700 Cr. market and is growing at 15% YoY. During the pandemic, this demand accelerated in both the local and global markets and the sector witnessed some very innovative and quick shifts.

The industry offers opportunities in the domestic and export market. Three elements are critical to ensure successful market entry & sustained business performance. We elaborate on these in this paper.

- Manufacturing processes, standards and the regulations governing them

- Customer and distribution channel behaviour

- Potential in Indian and Overseas markets (Regulated and Less Regulated markets)

Introduction

The Indian healthcare industry is valued at Rs. 20 Lac Cr. (FY 20) and is expected to grow 15% YoY. Medical devices and consumables, a part of this industry, is made up of 4 subsegments (Figure 1):

Figure1: Medical Device Segment of India

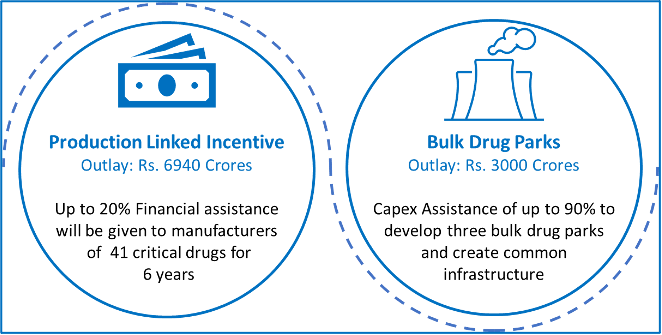

Several estimates present an extremely favourable picture in the future for the medical devices and consumables segment. Steps taken by the Government – Sunrise sector under Make in India plans, production linked incentives to manufacturers, updated medical devices rules and policies, funds for infrastructure development (medical device parks) – are expected to bear fruit.

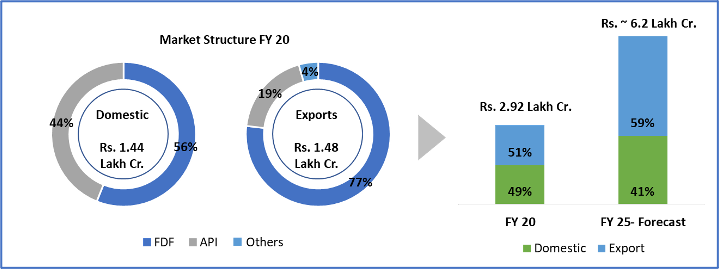

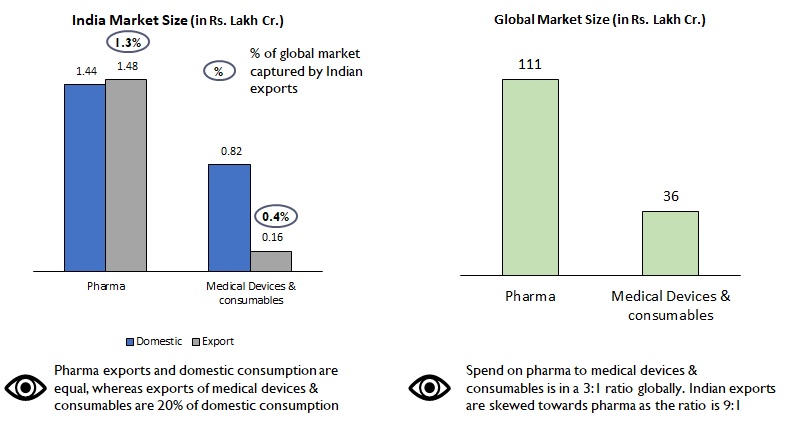

India’s exports contribute to 1.3% of global demand in pharma as against 0.4% in devices and consumables (Figure 2). Also, 50% of our exports of pharmaceuticals (Rs. 75 lac Cr.) are primarily to the more regulated markets of USA, Western Europe, therefore commanding a premium in both product range and price. However, in the medical devices and consumables space, our exports are skewed towards African and Middle Eastern nations with Indian brands targeting the economy product range.

Figure 2: Comparison of market size – Pharma vs Medical devices & consumables

India’s penetration in pharma and medical devices and consumables industries are very different. Domestic pharma manufacturers have advanced facilities that can manufacture drugs of high complexity, whereas in the devices and consumables segment, manufacturing capacity & capability are still at a nascent stage. The segment is characterized also by lack of superior technical expertise, high degree of fragmentation and focus on mass vs premium and niche products/ markets.

We believe that India can extend its superior standing in formulations to become a global leader in devices & consumables as well. With our knowledge and experience of pharma regulation across markets, India has a clear advantage and possibly a head start (as regulation on devices and consumables are generally not as complex for majority of the products) in this sector. Proactive Government policies and funds, growing interest among Indian manufacturers to tap into the vast global market (~Rs. 36 Lac Cr.), pandemic led demand growth and global interest in developing a 2nd manufacturing source beyond China should work in India’s favour. By 2025, experts believe India’s market may grow from Rs. 81,700 Cr. to Rs. 3.7 lac Cr. at a staggering 42% CAGR. Even conservative estimates peg the CAGR at 21% taking the market to Rs. 2.1 lac Cr.

The coronavirus caused an unprecedented surge in demand drawing considerable interest to this segment. For instance, Skanray Technologies formed a consortium with Mahindra & Mahindra and BHEL to manufacture up to 5,000 ventilators a month. Our PPE production capacity exploded from 62 lacs/ yr. to 26 crores/ yr. within a 3-month period thanks to 100+ manufacturers filling the void. Likewise, FMCG and Alcobev manufacturers produced and sold (also donated) alcohol-based hand-sanitizers. Large and small entrepreneurs in textile and apparel started supplying masks, gloves, and coveralls to institutional and individual buyers. While these examples are laudable, it is not enough to distinguish India in the medical consumables space and a more thought through, structured approach is needed to establish global leadership. This is however easier said than done. The segment has its own nuances and complexities. In this document, we examine the most critical of these to succeed.

- Manufacturing processes, standards and the regulations governing them

Manufacturing regulations are more stringent vis-à-vis other industries but create robust entry barriers

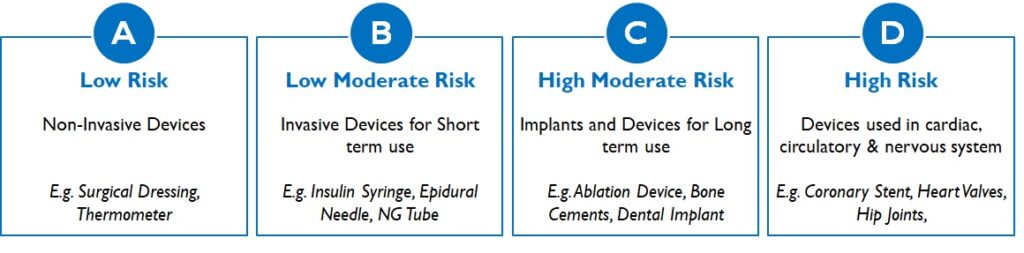

Medical devices are regulated by the Central Drugs Standard Control Organisation and fall under the purview of Indian Medical Device Rules, 2017. It categorises medical devices into 4 risk classes based on the invasiveness, duration of use and criticality of organ / organ function (Figure 3):

Figure 3: Medical Device Classes in India

According to the class of the device and the inspection process, approval authority and timeline to receive a manufacturing licence vary. A Class A/ B device maybe granted a licence in 45 days; whereas for a Class C/D device, licences can take up to 6 months (Figure 4).

Figure 4: Regulatory requirement for Class B and Class D Device

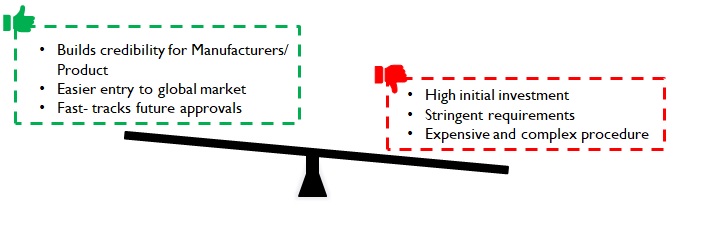

Compliance with extremely strict FDA/ EU regulations is required for export to regulated markets. Customers may expect USA, EU or WHO GMP certification for the manufacturing plants. Further, as medical devices are made in clean rooms, manufacturers have to upgrade their facilities to ISO Class 7 and below (varies basis product) to get the necessary clearance. To meet these standards, initial investment will be high, but the approvals bring credibility to the product and manufacturer. These ease entry into domestic as well as global markets and fast-track future approvals.

Figure 5: Implications of stringent regulations

Long lead times to regulatory approval impact time to market

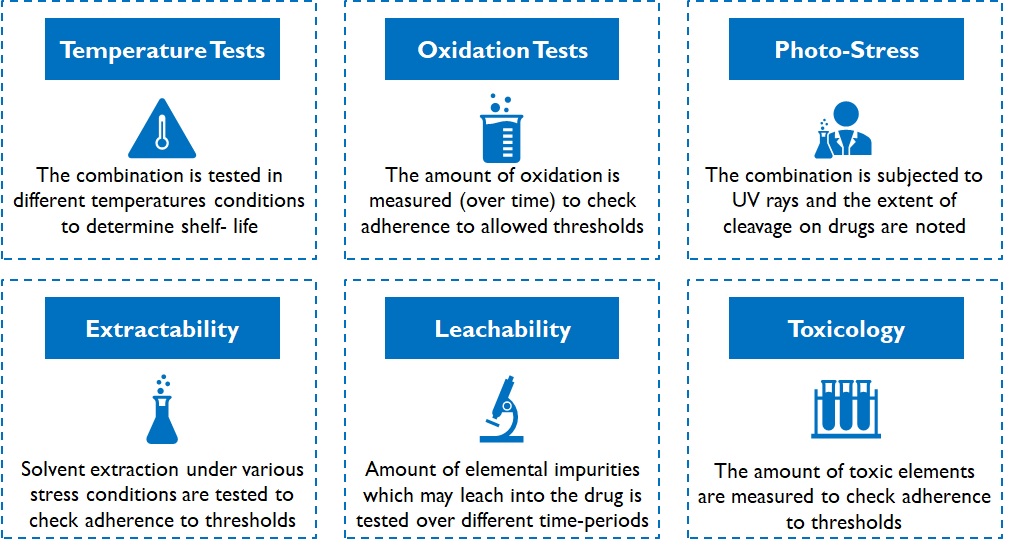

Devices can be classified as: devices with predicate or innovative devices. A device with predicate has the similar intended use, material of construction, and design characteristics as one that already has a licence and hence are eligible for manufacturing and import licences without clinical trials. Clinical trials are mandatory for innovative devices, and only after acceptable results are generated, a manufacturing/ import licence is granted. These mandatory tests determine the device’s performance and safety over several environmental conditions and may even require animal/ human trials. For instance, various kinds of stability and integrity tests are conducted on packaging material of drug products (Figure 6).

Figure 6: Types of tests conducted on packaging material of drugs

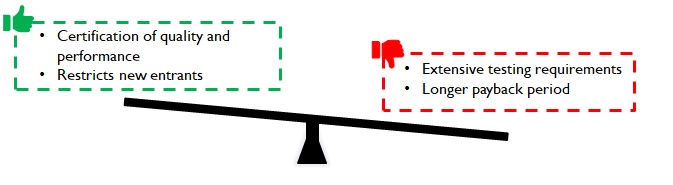

Testing duration depends on the shelf-life of the product in case of packaging consumables for drugs. For instance, oxidation tests on cotton for tablet bottles is conducted over a sufficiently large duration (3 – 6 months or more) and results are extrapolated (simulated) further for longer shelf life declarations. Despite simulations, fast-tracking is not very easy. Customers (pharma companies) and regulatory authorities do not dilute / deviate from conservative practices. While the time to develop a viable product may range between 1 – 3 years, depending on product complexity, it acts as a robust barrier for new entrants.

Figure 7: Implications of long lead time

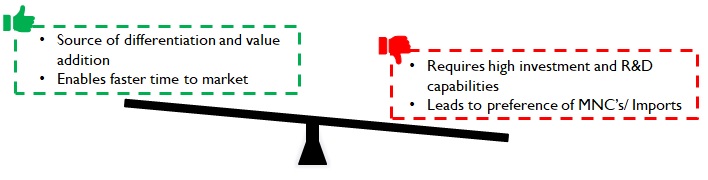

Manufacturers can command premiums with solutions that lead to faster time to market for customers in select product-market combinations

Testing is often conducted and funded by pharma companies. Devices and consumables manufacturers have started to realize this as a source of value addition that commands a premium. For example, Daywyler – a manufacturer of vial stoppers has vast quantities of data on drug reactions for various stopper material compositions. Predictive analytical models generated using this data help Datwyler not just suggest appropriate material compositions for new products, but also help fast track regulatory approvals with years of actual test / use data. This allows pharma companies to be faster with the drug in the market, thereby adding considerably to their revenues and profits.

Datwyler also boasts of an excellent R&D and Regulatory advisory, capable of identifying the minutest of defects and conducting detailed root-cause analysis (in case of product recalls post go-to-market). Pharma companies value this support during contingencies and the subsequent speedy resolution of issues. Most domestic manufacturers in India do not possess high levels of such competencies and hence are substituted by imports despite higher cost and longer lead times.

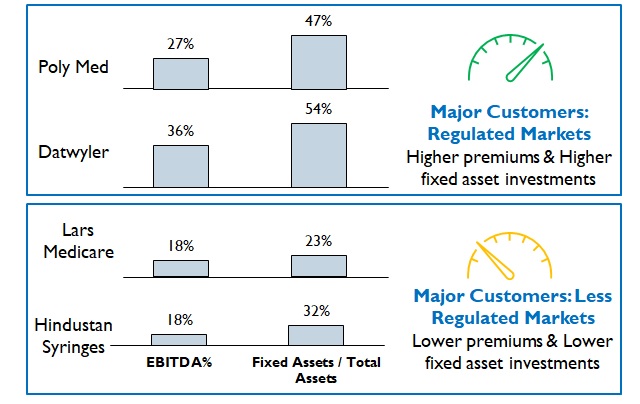

Figure 8: Comparison of Profitability and Investment for different markets

However, premiums commanded depend upon the Product / Market combinations (Figure 8). For example, fluid / wound / fracture management products for Africa or South Asia will require a much lower investment in R&D capabilities and hence command lower premiums.

Figure 9: Implications of product premiumness

- Customer and distribution channel behaviour

Conservative customers with inertia impact pace of change but once entrenched yield long-term returns

Customers in the healthcare segment insist on high regulatory compliance from their devices and consumables suppliers. For instance, to partake in RFQ process in top hospital chains in India (especially for Class C or D devices), manufacturers often mandate FDA Approval/ CE Mark for the products and WHO GMP certification for the facility. This is driven by concerns over product quality and costly damage claims associated with defects.

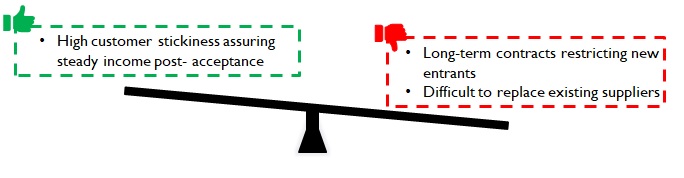

Sales of consumables to pharma companies (Eg: cotton for tablet bottles), or component parts to device manufacturers suffer a high level of customer inertia to any change. For instance, a new supplier may necessitate re-doing the approval process from the start – including manufacturing audit of Tier 2 suppliers (if req.). Hence pharma companies tend to remain associated with suppliers over long contractual periods i.e. during the entire lifecycle of a drug.

Despite the challenges, customers onboard new manufacturers if they can reduce supply lead times leading to incremental revenues; or offer the required quality at lower costs thus adding to their bottom line. While the customer stickiness may prove to be a barrier to entry; once customers are onboarded, a steady source of revenue is assured for a considerable period.

Figure 10: Implications of customer inertia

Distinct distribution network (with distinct regulations) is critical for reach and growth

The distribution network for medical devices to hospitals, clinics and dispensaries include multiple intermediaries: distributors, dealers, and sub-dealers (also called surgical dealers), who require a CDSCO licence. The multi-level network ensures last-mile delivery and can cater to emergency demands. Central procurement of large hospitals roll-out annually/ bi-annually tenders (Figure 12):

Figure 11: Supplier selection process

For premium products, doctors play a significant role in brand selection (specifically for more critical products); they stick to familiar brands and tend to be very loyal. In the case of mass market products (Eg: disposable syringes) the L1 bidder tends to get the contract. Medical device representatives engage doctors through seminars, conferences, product demonstration and samplings to convince them about new brands/products.

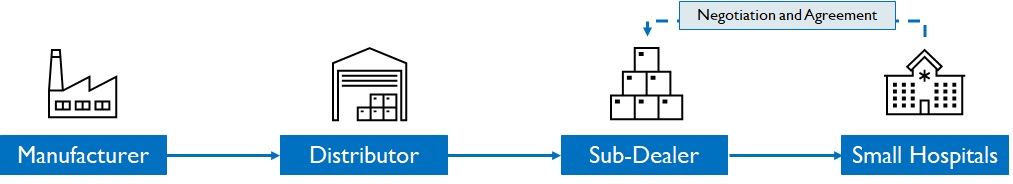

For clinics, dispensaries and small hospitals in tier 2/3 cities, surgical dealers play a pivotal role in promoting brands to doctors, consolidating orders, and negotiating with hospital team (Figure 12). Dispensaries are important as availability translates into sales highlighting the strength of the distribution network. Manufacturers invest in BTL marketing on dealers (schemes, incentives) to be successful in this segment. (Figure 12)

Figure 12: Distribution process in Small hospitals, clinics, and dispensaries

Manufacturers must be ready to build a sales organization and invest in BTL for market coverage. Distribution is unique; it is a combination of channel/ product/ institution and hence fine tuning the selling approach focusing on the organization’s aspirations and capabilities is critical for success.

Figure 13: Implications of Distinct distribution Network

- Market potential in India & abroad (Regulated & less regulated markets)

Potential for import substitution and profitable export is high

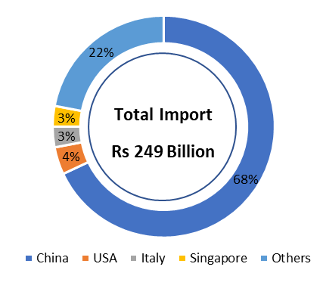

In 2019-20, India imported medical devices worth ~ Rs. 42,000 Cr.; the import dependency is as high as 86-90% for few high-end medical devices due to lack of medical grade indigenous manufacturing capacity. Imported brands like Beckton Dickinson, B Braun, Boston Scientific, Medtronic and Datwyler have high share in domestic market despite high prices, due to customer stickiness and their proven technical and manufacturing standards.

Medical devices are expected to be a flag-bearer of the Make-in-India initiative, and the Indian government is incentivising domestic manufacturing through a Rs 3,800 Cr. stimulus package. Indian manufacturers can compete with the MNC’s on cost, lower lead time and offer products that meet standards. They can establish themselves in the domestic market by initially targeting Tier 2/3 hospitals to gain brand recognition and then enter the bidding process for Tier 1 hospitals. An “invest as you earn” approach will put Indian brands on a solid path to growth and profitability as they move from import substitution to less regulated markets to regulated markets.

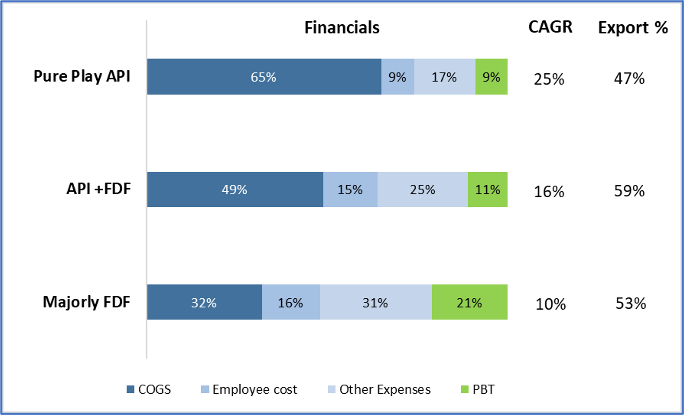

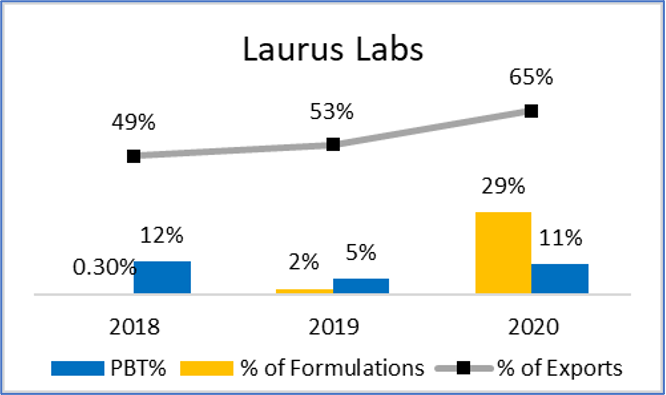

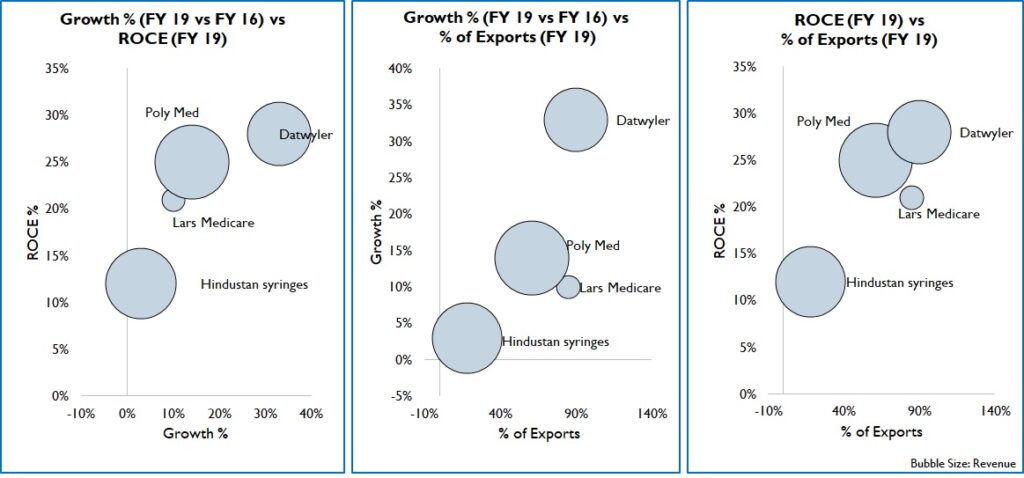

India exported Rs, 15,530 Cr. worth of medical devices in 2019, most of which were on the low-end like tubes, IV Cannulas, Breathing bags etc. These exports were to markets of Africa, Middle east, South America, and SE Asia with similar/ less stringent regulations than India. Over the years, by partnering with international healthcare NGO’s and local governments, Indian products have become widely acceptable. This is supported by good distribution network and local sales offices. Since cost is a key factor for purchase, Indian products in both high and low-end segments have good potential. Firms that target export markets can expect high growth and returns (Figure 14).

Figure 14: Comparison of Growth, Returns and Export %

A more detailed breakout of the import substitution and export market potential viewed through the lens of existing and new capabilities, product-market combinations and investment vs payback can sharpen the market entry / growth strategies of existing players and new entrants.

Figure 15: Implications of Import dependency

Conclusion

The market potential for medical devices and consumables is very high and investor interest is significant. While market size is just one axis to measure a market’s attractiveness, it is imperative to assess complexities across the value chain for entry or growth. These complexities and nuances are unique to the sector and hence a long-term play is advised – building competence and niche product capability, partnering with technical experts, creating a sustainable distribution presence, customer loyalty and keeping a good balance between domestic and exports for growth and profitability.

Authors: Samiran Das, Giridharan Raghunathan and Vasupradha Sridharan